Dec 20, 2024

The markets experienced a sharp downturn following the Federal Reserve's decision to cut rates by 0.25%, paired with Chair Jerome Powell's comments on economic uncertainty and a revised rate projection. Despite aligning with expectations of two cuts in 2025, the Fed's tone about “higher for longer” rates and inflation sparked a reaction akin to panic selling. The S&P 500 dropped nearly 3%, the Dow hit a record 10-day losing streak, and the dollar strengthened, reducing interest in risk assets like crypto. Powell emphasized the unpredictable economic landscape, compounded by fiscal uncertainties, such as potential government shutdowns. While the Fed’s cautious adjustments aim to stabilize inflation, the markets reacted with heightened volatility, illustrating their messy and sometimes irrational nature when processing such news.

Federal Reserve Chair Jerome Powell has also stated that the Fed has no plans to hold Bitcoin, citing legal restrictions and no interest in pursuing legislative changes. He dismissed the idea of a U.S. Strategic Bitcoin Reserve, proposed by President-elect Trump, leaving such decisions to Congress. Powell’s comments likely added to the sell pressure causing Bitcoin’s value to dip, following recent gains tied to optimism around a pro-crypto administration.

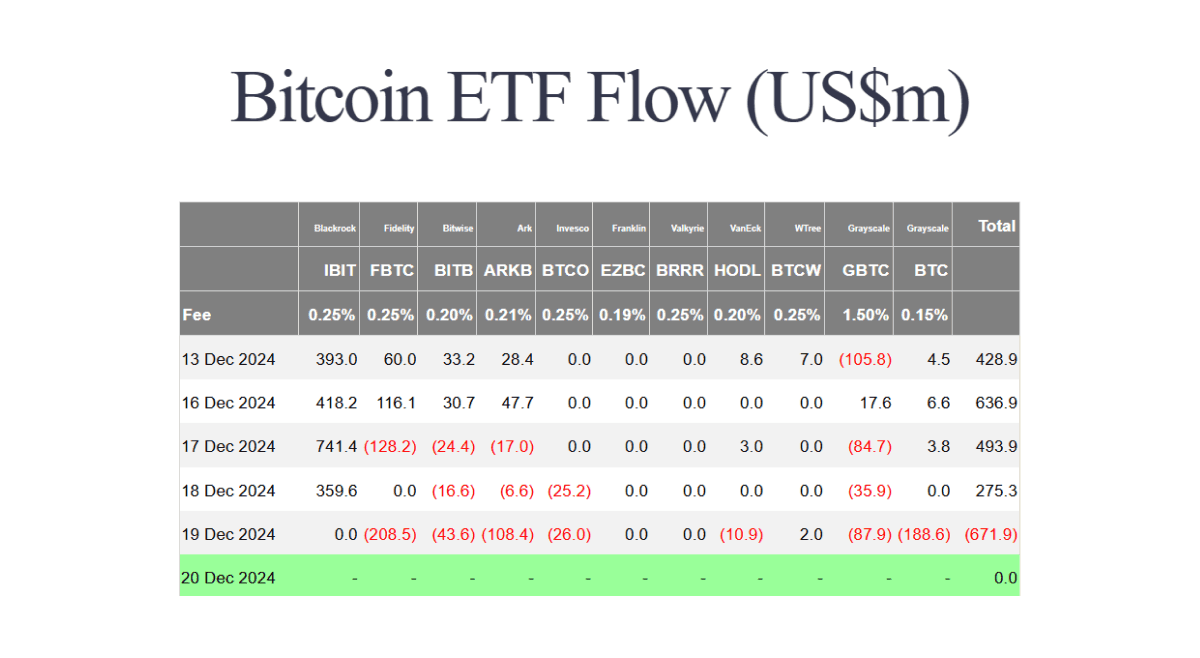

Bitcoin ETF flows have been somewhat volatile over the past week, reflecting fluctuating market sentiment amid the broader economic uncertainty. Notably, Blackrock's IBIT fund saw significant inflows early in the week, peaking at $741.4M on Tuesday, before total flows turned negative by December 19, coinciding with an overall outflow of $671.9M across ETFs. Positive inflows from earlier in the week still outweigh the outflows from yesterday, today will be interesting.

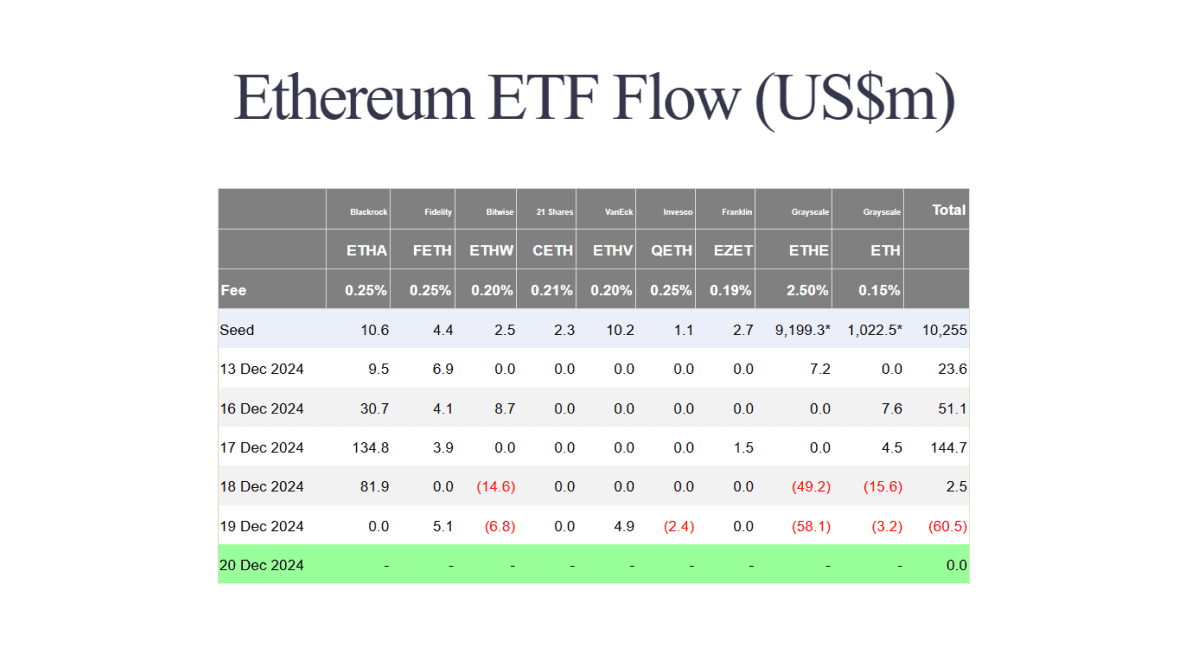

Ethereum ETF flows experienced significant volatility this week, reflecting shifting market sentiment amid broader economic uncertainty. Early optimism gave way to notable outflows as investors reacted to the Fed's policy updates and reduced risk appetite. Despite this, Ethereum’s ecosystem remains resilient, with ongoing development in scaling solutions and decentralized applications.

The 12 Days of Christmas on Metal Pay!

This holiday season, we’re celebrating with 12 days of free trading on Metal Pay! Each day features a special token with no trading fees (excluding debit or credit card processing fees), spreading festive cheer and giving users a chance to explore the wider crypto ecosystem.

Today’s token is MTL, the cornerstone of the Metal ecosystem. For the next 24 hours, you can trade MTL with zero fees! As the native governance and utility token of the Metal DAO, MTL empowers users through network governance and seamless access to the best DeFi protocols.

In other exciting MTL news, Velodrome pools are now live on Metal L2, marking a significant milestone for the ecosystem. Velodrome, one of the largest decentralized exchanges (DEXs) on Optimism, brings its proven MetaDEX framework to Metal L2. This enables deep liquidity, seamless trading, and access to one of the world’s largest DEXs. The launch of Velodrome on Metal L2 enhances opportunities for users and protocols to engage in a thriving DeFi ecosystem. As part of this deployment, the Metal (MTL) DAO community voted to deploy over 1m MTL in incentives for those that want to help provide liquidity and contribute to Metal’s growing presence in the wider DeFi ecosystem. Stay tuned to learn more about how you can take advantage of these liquidity incentives.

Celebrate the holidays with free trading on Metal Pay* and explore the growing possibilities on Metal L2 with Velodrome’s launch!

Start Trading

* excluding debit & credit card fees