Oct 18, 2024

I think it’s probably fitting to start this week off with a meme:

Spot Bitcoin ETFs have broken $20 billion in inflows after a $1.85 billion surge this week that sent BTC back above $68’000 USD. It took Gold ETFs literal years to achieve what Bitcoin has done in mere months, truly a testament to the perceived value of the digital assets scarcity.

Taking a look at our trust Bitcoin ETF Flow chart we can see that BlackRock’s iShares Bitcoin Trust (IBIT) has been a major contributor to the inflows. BlackRock’s net assets stand at over $25 billion, with the Bitcoin ETF now accounting for 1.95% of the entire Bitcoin market share of $1.3 trillion.

The $1.3 trillion market cap of Bitcoin now firmly cements it as the tenth largest asset by market capitalization, just above the trillion dollar valuation of TSMC and below the $1.46 trillion valuation of Meta Platforms (Facebook)

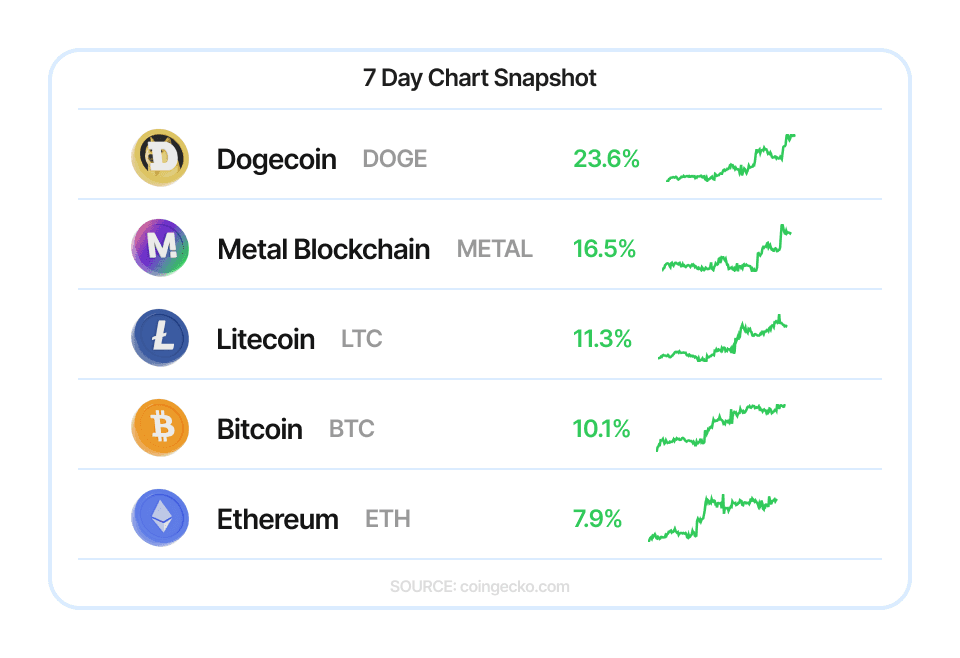

Bitcoin isn’t the only one in the green this week, “a rising tide lifts all boats” as they say. Dogecoin enjoyed a 23.6% surge on the 7 day chart, more than double that of Bitcoin and Litecoin.

In Metallicus ecosystem news this week, the Metal DAO governance proposal by oku.trade to deploy Uniswap v3 on Metal L2 has hit quorum, but there is still time to make your vote count. MTL holders with their tokens on XPR Network using WebAuth Wallet can visit the Metal DAO community here to review and vote on the proposal.

Paul Grey spoke to Getty Hill from Oku about the proposal, what it means for MTL holders and how they can take advantage of the proposed incentive program. Tune into the recording here if you have an X.com account to learn more or read more here. Voting for the proposal closes on the 26th October.