Nov 15, 2024

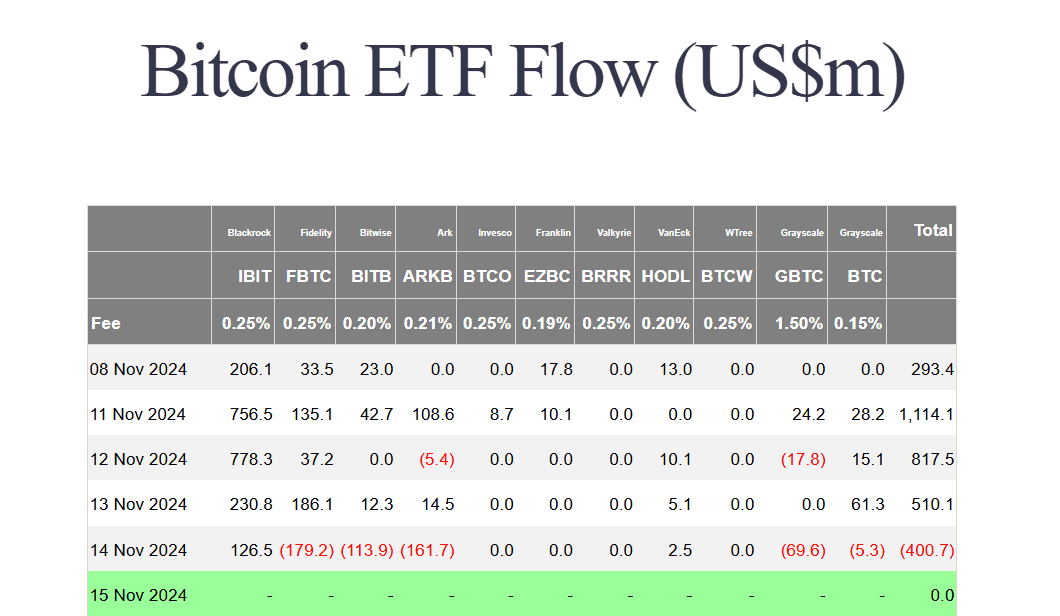

Bitcoin continued its uptrend this week breaching an eye watering $93’000 on Wednesday and continuing to hold between $87-90K level even after heavy profit taking from some of the large funds yesterday. The surge is attributed to the expectations of a more favorable regulatory environment under incoming President Elect, Donald Trump's new administration.

We can see on Thursday there were large outflows from the likes of Fidelity, Bitwise and Ark so it will be interesting to see what happens by market close today.

Ethereum experienced notable inflows and outflows this week, with the price managing to hold between $3,000 despite big fluctuations. Early in the week, inflows from major players such as Blackrock and Fidelity pushed momentum higher, driving increased optimism in the market. However, later in the week, we saw substantial outflows from funds like Grayscale and Invesco, likely reflecting profit-taking activities as investors reacted to broader market conditions. The sentiment remains cautiously optimistic, but all eyes are on how Ethereum will close the week, especially after seeing funds adjusting their positions on Thursday.

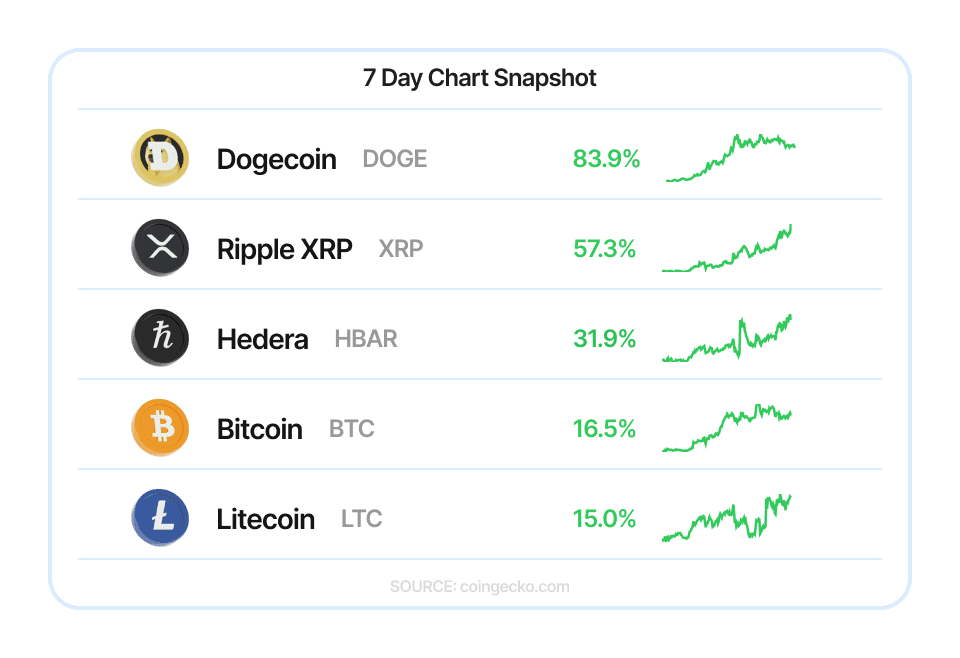

Dogecoin (DOGE) saw an impressive rally this week, soaring by 83.9%, making it the top-performing cryptocurrency on the 7-day chart. The surge is largely attributed to the excitement and speculation surrounding Elon Musk's playful yet impactful move to introduce the “D.O.G.E.” – Department of Government Efficiency.

The humorous announcement stirred up significant attention and led to renewed enthusiasm among Dogecoin supporters. The market's response has been overwhelmingly positive, with traders and investors flocking to DOGE in anticipation of further lighthearted endorsements or potential applications related to this concept.

As always, Musk's influence on the meme cryptocurrency remains as potent as ever, driving up both interest and value but it should be noted that there are no official partnerships between Dogecoin and any government agencies.