Mar 14, 2025

The cryptocurrency industry is on the verge of a major legislative victory as the Senate Banking Committee (US) passed a bill establishing a regulatory framework for stablecoins. This bipartisan effort signifies a shift towards legitimizing the crypto sector, reflecting extensive political engagement by industry stakeholders. While some critics express concerns over consumer protections and financial stability risks, the strong legislative support indicates a move towards integrating digital assets into the existing financial infrastructure.

Bitcoin prices hovered around $84,000 before analysts forecasted a potential drop to $73,000 amid a prolonged pullback. Analysts note similarities to the end of the 2021 crypto bull market and highlight shifting market narratives from payments to DeFi/NFTs and meme coins. The current conditions mirror previous cycles where speculative hype eventually succumbed to reality. Bitcoin's price action is influenced by macro headwinds, including US-China tariff escalations and the Federal Reserve's hawkish stance.

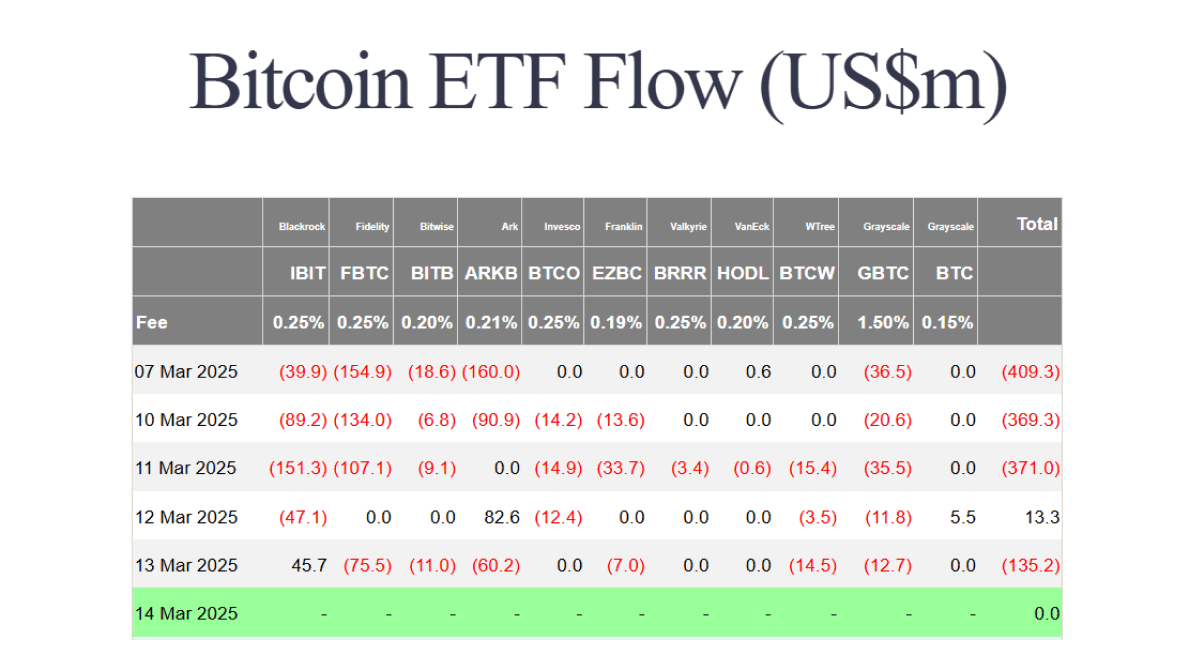

Looking at our trusty Farside data, Bitcoin exchange traded funds (ETFs) have experienced significant outflows, with investors retreating amid market volatility. Since mid-February, Bitcoin ETFs have witnessed total outflows of nearly $5 billion, with over 800 million in outflows this week alone. This trend reflects broader investor caution in the face of economic uncertainties.

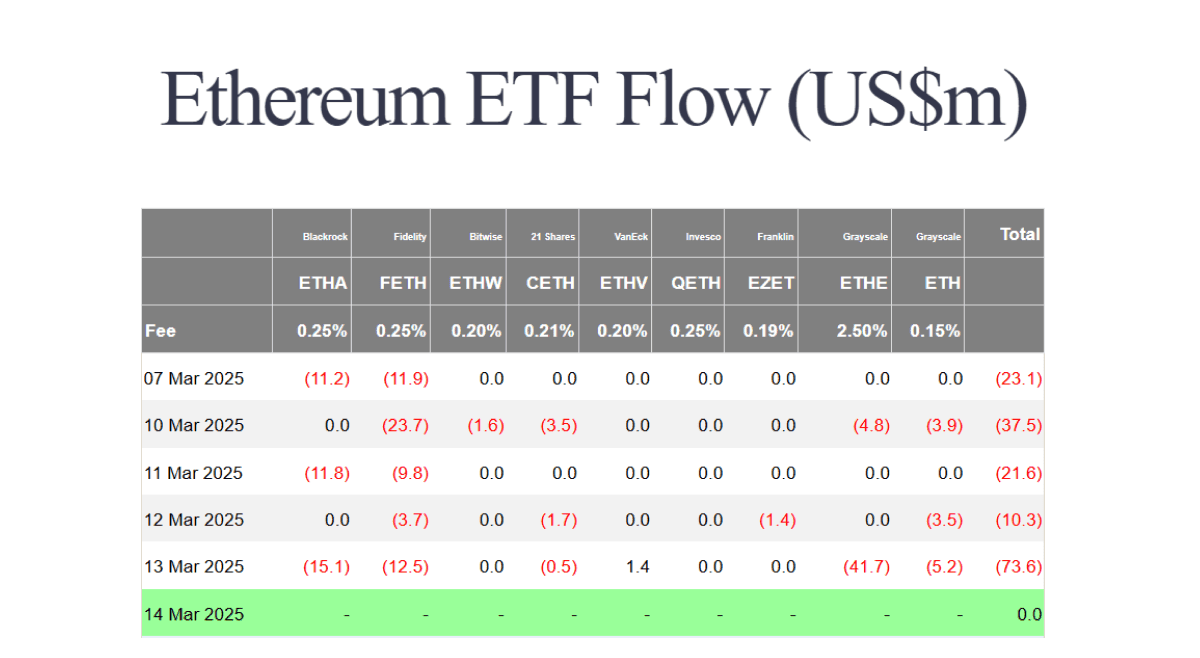

Ethereum ETFs faced continued pressure this week, mirroring broader crypto market volatility. Significant outflows were observed across key funds, notably Grayscale's ETHE, which saw $41.7 million in withdrawals on March 13 alone. Fidelity's Ethereum fund (FETH) also experienced consistent outflows throughout the week, highlighting investor caution amid uncertain regulatory developments and macroeconomic conditions. Market sentiment remains tentative, and investors appear to be waiting for clearer signals before recommitting to Ethereum based financial products.

Just like the past few weeks I have a brand new tutorial video, this time I’m speed running the XPR Network (XPR) Block Explorer. If you don’t know, a block explorer is where you can see transaction history and all of the actions that happened onchain, at any point in time. This video explains the basics of the explorer and how to navigate the various functions.

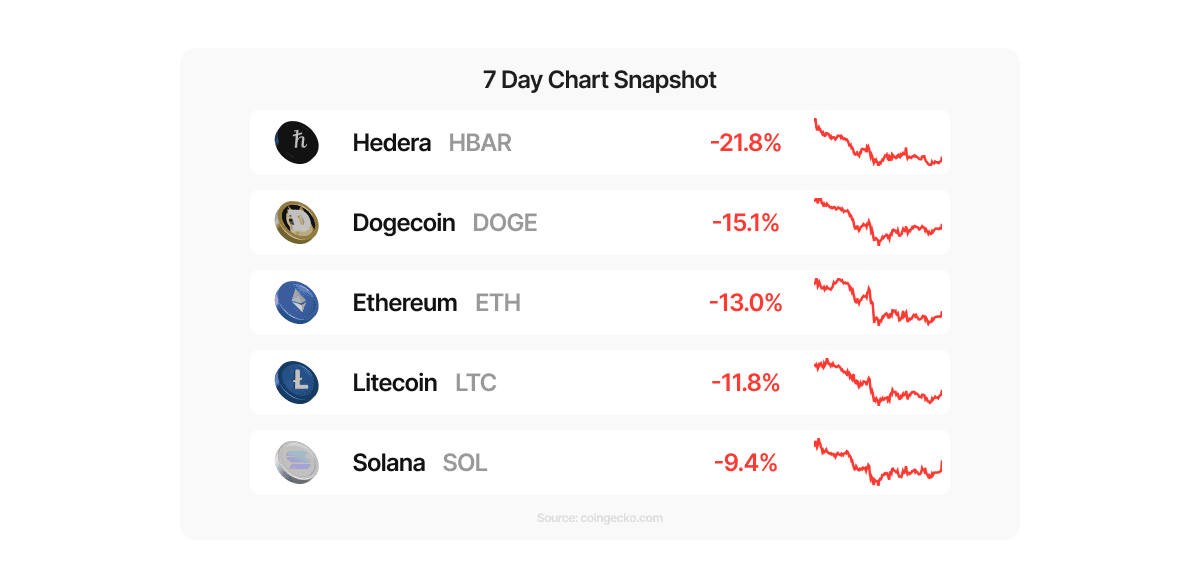

Every digital asset in our tracked tokens is down on the 7day, so this week we are highlighting the biggest dippers, with HBAR, DOGE, ETH and LTC leading the pack, all in double digit percentages. Eagled eyed readers will have noticed some relief on the tail end of those charts with a healthy correction happening as we speak. Switch to the 24h chart and things are looking a bit better.

Ready to buy the dip? These assets and more are available on Metal Pay.