Feb 14, 2025

This week, the cryptocurrency market navigated a complex landscape shaped by significant economic announcements. On February 10, President Donald Trump declared a 25% tariff on all steel and aluminum imports, effective March 12, removing previous exemptions. He also introduced a "reciprocal tariff" policy, stating, "If they charge us, we charge them," targeting countries with higher tariffs on U.S. goods. These moves aim to address trade imbalances but have raised concerns about potential trade wars and their impact on global markets.

In parallel, Federal Reserve Chair Jerome Powell testified before Congress, emphasizing that recent inflation data indicates the Fed has "more work to do" to achieve its targets. The Consumer Price Index (CPI) revealed a 0.5% increase in January, the most significant rise in nearly 18 months, driven by higher costs in shelter, food, and gasoline. Powell suggested that interest rates may remain elevated longer than previously anticipated to curb inflation.

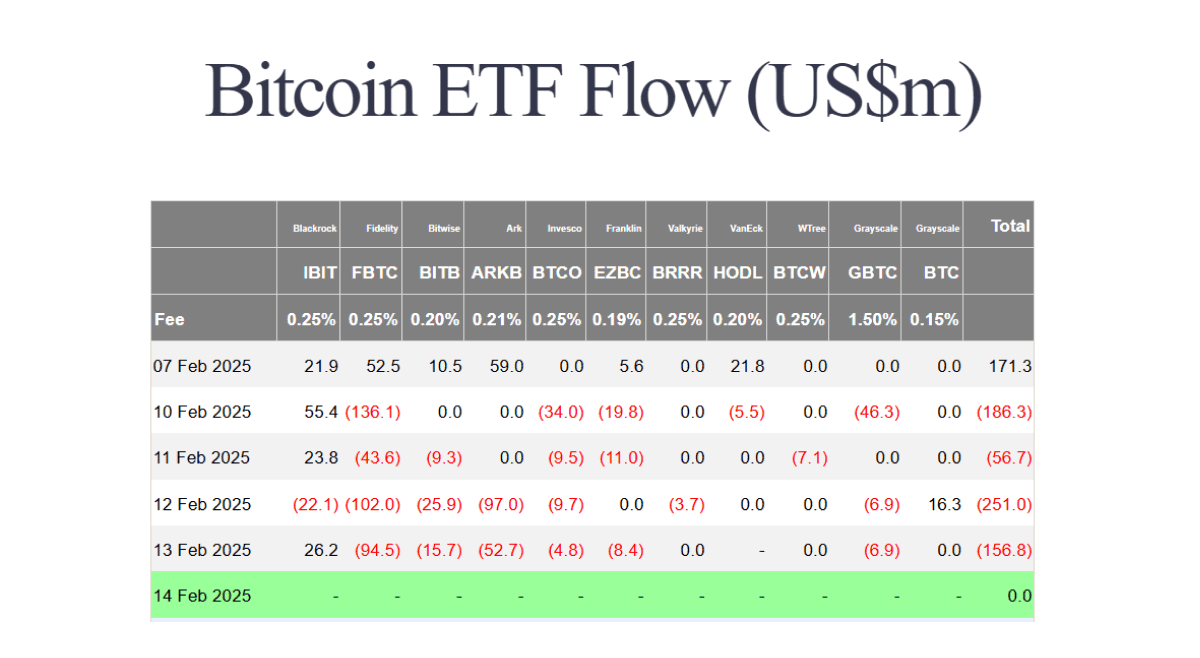

Bitcoin ETFs experienced notable activity this week. On February 12, there were $251 million in net outflows, primarily from Fidelity’s FBTC and Ark Invest’s ARKB funds. However, by February 13, the trend reversed with modest inflows, indicating a potential stabilization as investors reassessed their positions amid the evolving economic landscape.

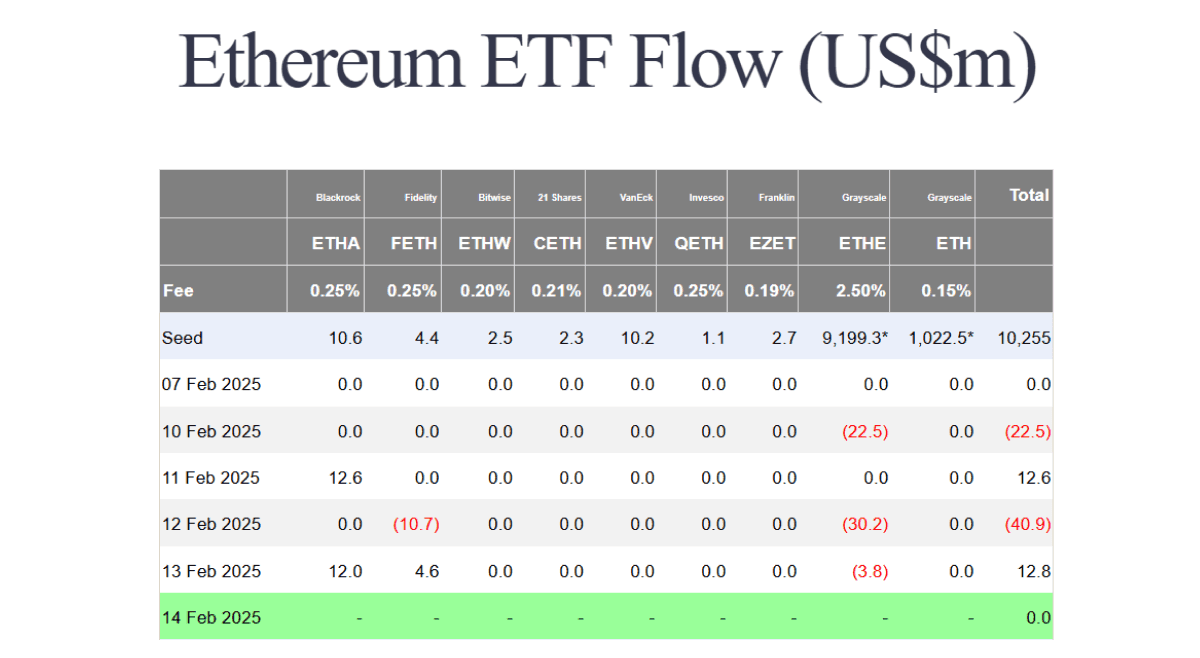

Ethereum ETFs faced mixed demand during the same period. The February 12 session saw $40.9 million in outflows, led by Grayscale’s ETHE and Fidelity’s FETH. Unlike Bitcoin, Ethereum did not experience a significant rebound in ETF flows the following day, suggesting a more cautious stance from investors regarding ETH-based assets.

In a notable development, Citibank is reportedly exploring the launch of cryptocurrency custody services. This move aligns with a growing trend among traditional financial institutions recognizing the increasing demand for secure digital asset storage solutions. Citibank's potential entry into the crypto custody space could provide a significant boost to institutional adoption, offering clients trusted avenues to engage with digital assets.

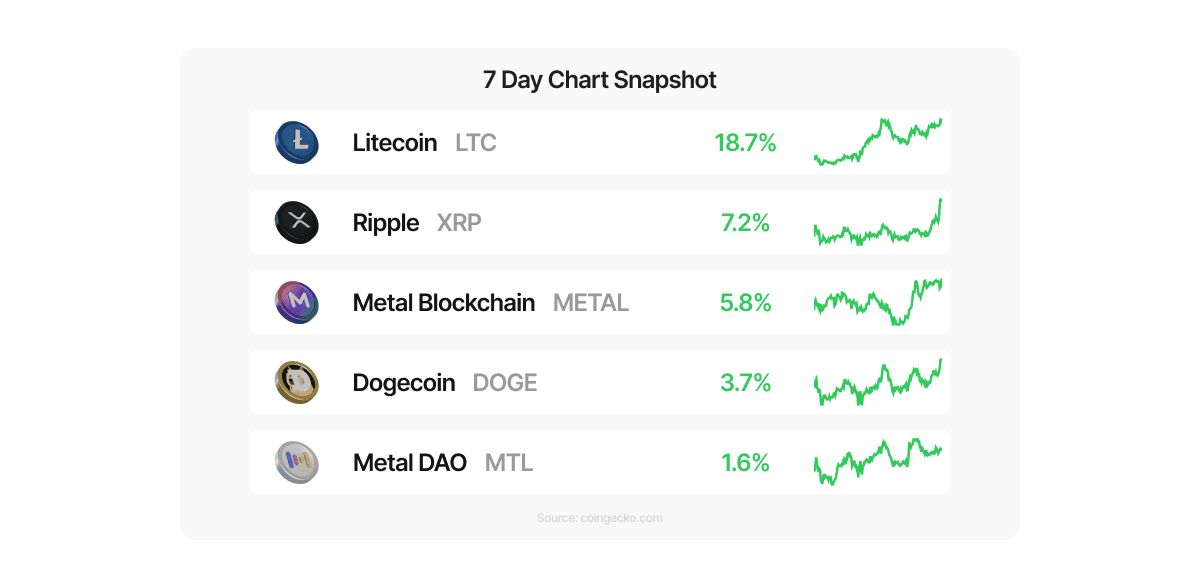

Despite a turbulent market, a handful of assets posted positive returns over the past seven days. Litecoin (LTC) led the gains, climbing 18.7%, continuing its strong performance following increased network activity and adoption. XRP followed with a 7.2% increase, as investor sentiment remained positive amid ongoing discussions around regulatory clarity. Metal Blockchain (METAL) saw a 5.8% rise, reflecting renewed interest in blockchain solutions tailored for banking and financial institutions. Dogecoin (DOGE) posted a 3.7% increase, showing resilience in an otherwise volatile week. Lastly, Metal DAO (MTL) closed out the top five with a 1.6% gain. While these assets outperformed the broader market, sentiment remains cautious as macroeconomic factors continue to influence trading conditions.