Jan 10, 2025

Bitcoin fell 2% this week, trading around $93,500 as market sentiment wavered amid heightened U.S. Treasury yields and signals from the Federal Reserve of a more cautious approach to monetary easing. Analysts have pointed to key support levels at $92,000, with resistance still hovering near the psychological $100,000 mark. While the decline is notable, optimism for the year ahead remains strong, with some experts projecting Bitcoin could surpass $200,000 before the year ends.

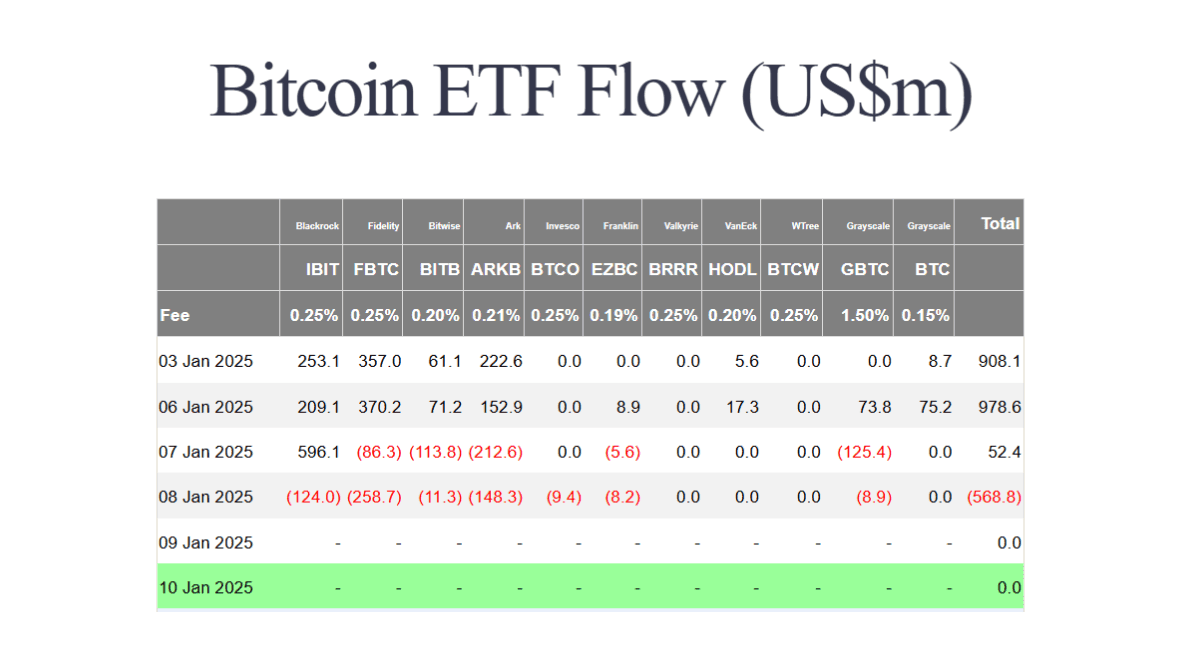

In early January, Bitcoin ETFs experienced significant outflows, reflecting caution among institutional investors. BlackRock's iShares Bitcoin Trust recorded a major withdrawal of over $332 million on January 1, marking its largest single-day outflow to date. Despite these early outflows, Bitcoin ETFs have remained a key vehicle for institutional interest. Analysts remain optimistic that Bitcoin ETF flows in 2025 could surpass last year’s totals, driven by factors like the upcoming Bitcoin halving and potential regulatory clarity under the new U.S. administration.

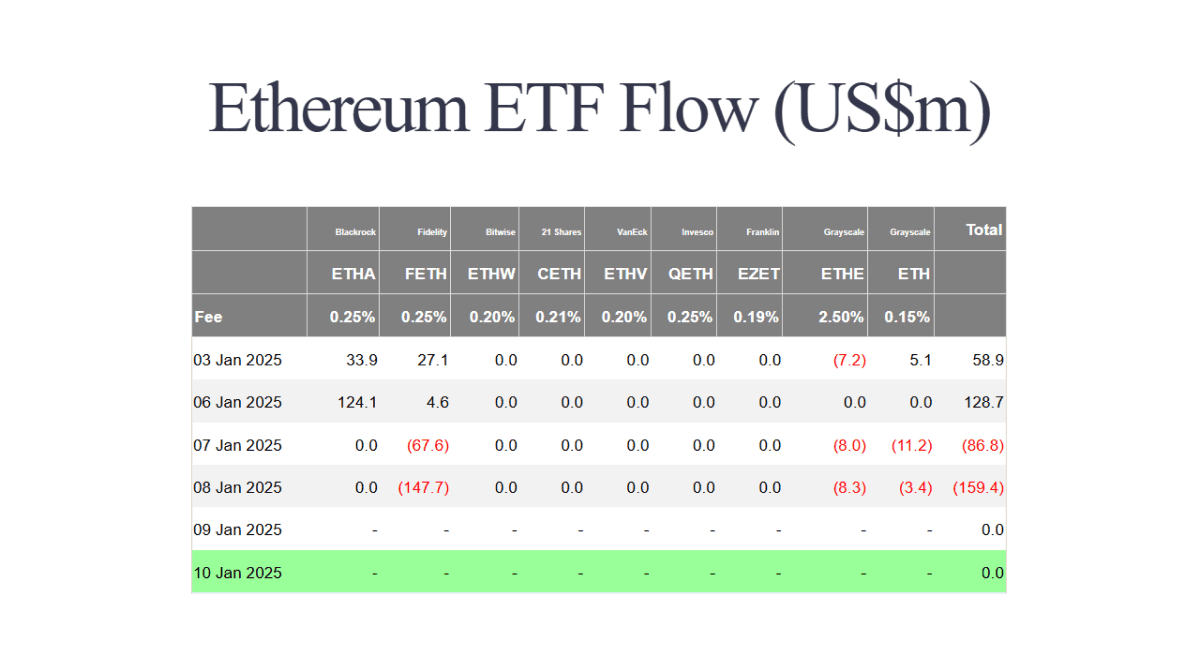

Ethereum ETFs also faced notable outflows in the first week of January. Major providers such as BlackRock and Fidelity reported net losses in their Ethereum-focused funds, reflecting reduced activity from institutional players. However, Ethereum’s role in the growing DeFi ecosystem and its continued utility in decentralized applications are expected to attract renewed interest as the year progresses. Analysts predict that Ethereum ETF flows could recover alongside broader market sentiment and innovation in its ecosystem.

In other news, the U.S. Department of Justice has announced plans to liquidate over 69,370 Bitcoin seized from the Silk Road marketplace, valued at approximately $6.5 billion. This marks one of the largest Bitcoin sales by the U.S. government to date and could introduce significant volatility into the market. Analysts are closely watching the impact of this liquidation, which underscores the ongoing intersection of cryptocurrency with law enforcement and government policy.

The U.S. Consumer Financial Protection Bureau proposed new regulations this week to enhance consumer protections for digital wallets, aligning them with traditional bank account standards. Meanwhile, the outgoing CFTC Chair highlighted the risks of the largely unregulated $3 trillion crypto market, calling for more robust oversight.

As we move further into 2025, all eyes remain on emerging trends, regulatory changes, and key market drivers. Stay tuned for more updates as we continue to bring you the latest developments shaping the cryptocurrency world!

Velodrome Pools Now Live on Metal L2

Please note, this next section is for intermediate to advanced users and does not constitute financial advice. Always conduct your own research and assess the risks before participating in DeFi.

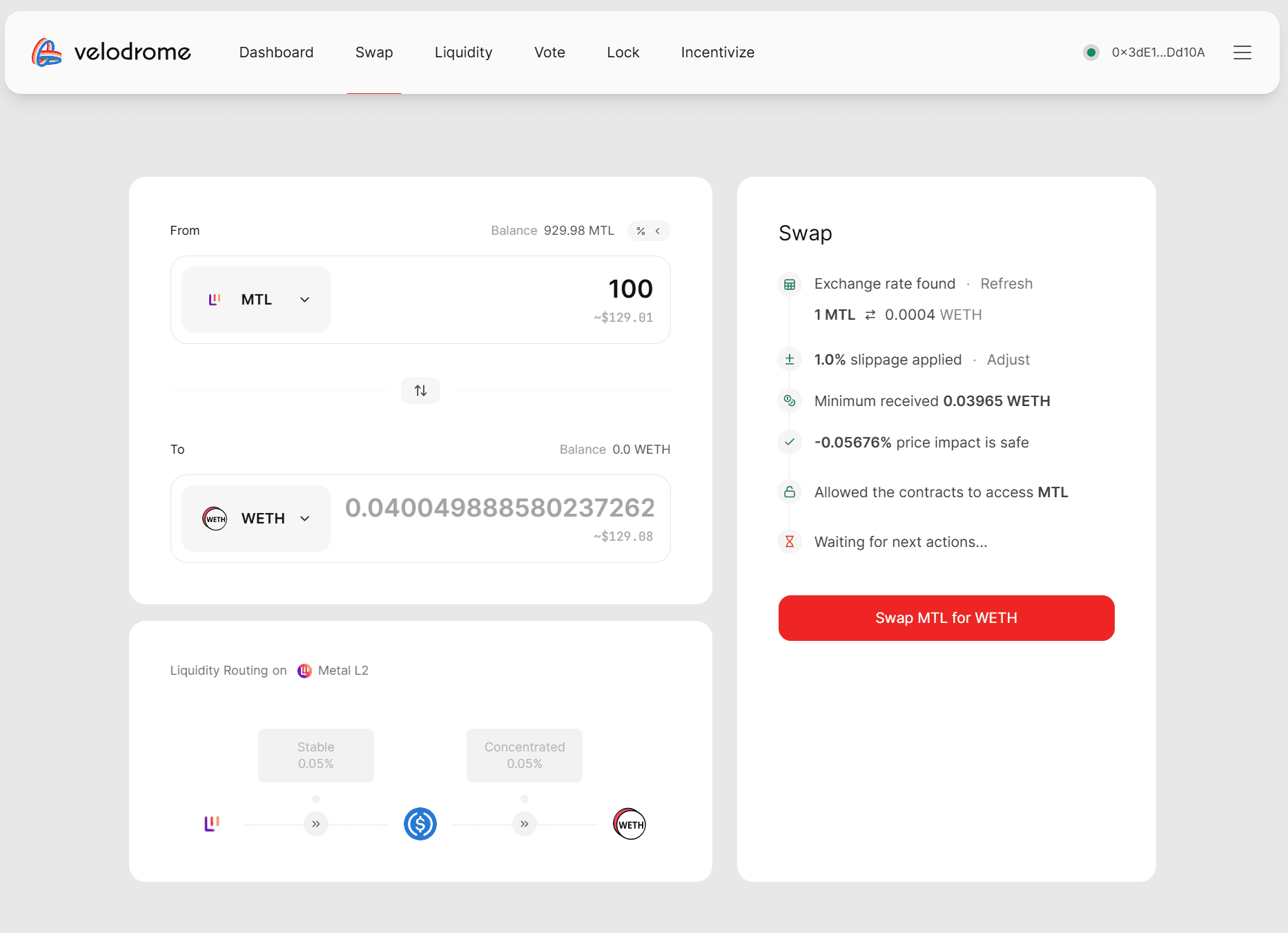

Velodrome, one of the leading decentralized exchanges on Optimism, has officially launched on Metal L2, offering fast, low-cost trading and liquidity opportunities to users in the Metal ecosystem. Velodrome combines automated market maker (AMM) pools with governance incentives, making it a versatile and rewarding platform for traders and liquidity providers alike.

The initial focus is on the vAMM-WETH/MTL pool, a pair that provides an accessible starting point for users interested in exploring liquidity provision. By contributing tokens like WETH and MTL to this pool, participants earn fees as trades occur, or can stake their liquidity to earn XVELO over time. These rewards can be further enhanced by leveraging Velodrome’s governance system to direct additional incentives toward specific pools, including WETH/MTL.

Users can bridge their xVELO to Optimism and convert it into VELO, Velodrome's utility token. VELO holders can lock their tokens to gain veVELO, granting governance rights and the ability to vote on token emissions for specific pools. Voting for the vAMM-WETH/MTL pool not only boosts rewards for liquidity providers but also opens the door to earning additional incentives, including MTL incentives offered by Metal DAO to encourage governance participation.

The process is straightforward:

Provide Liquidity: Deposit WETH and MTL into the vAMM-WETH/MTL pool on Metal L2 to receive LP tokens representing your share of the pool.

Stake LP Tokens: Stake your LP tokens on the Velodrome Dashboard to begin earning xVELO rewards over time.

Bridge and Lock VELO: Bridge your xVELO to Optimism to convert it into VELO. Lock VELO to obtain veVELO for governance voting.

Vote and Claim Rewards: Use veVELO to vote for the vAMM-WETH/MTL pool, boosting its rewards. Once weekly incentives are distributed, claim your earned MTL and other rewards.

With Velodrome now live on Metal L2, the Metal ecosystem takes a significant step forward in attracting liquidity, enhancing DeFi participation, and empowering users with governance tools. Remember to manage risk wisely, maintain sufficient ETH on Metal L2 and Optimism for transaction fees, and stay updated through official Metal L2 and Velodrome channels for the latest developments.

A more detailed guide is on it's way for those that want to explore the wider world of DeFi on Velodrome and other dApps outside of the Metallicus ecosystem.

Note: This is not financial advice. Always conduct your own research and assess the risks before participating in DeFi.